Title: Understanding Industrial and Commercial Bank of China (ICBC) Wealth Management: A Comprehensive Guide

Introduction to Industrial and Commercial Bank of China (ICBC) Wealth Management

Industrial and Commercial Bank of China (ICBC) is one of the largest and most prominent financial institutions globally, offering a wide range of banking and financial services, including wealth management. ICBC's wealth management services cater to diverse investment needs, providing customers with opportunities to grow their assets through various investment products and strategies. Understanding ICBC's wealth management offerings is crucial for individuals seeking to optimize their financial portfolios and achieve their investment goals effectively.

Key Features of ICBC Wealth Management

ICBC offers a comprehensive suite of wealth management products and services tailored to meet the diverse needs and risk preferences of its customers. Some key features of ICBC wealth management include:

1.

Diverse Investment Products

: ICBC provides a diverse range of investment products, including fixedincome products, equity investments, mutual funds, insurance products, and more. These products enable customers to build diversified portfolios aligned with their investment objectives and risk tolerance.2.

Professional Investment Advisory Services

: ICBC offers professional investment advisory services to assist customers in making informed investment decisions. Experienced financial advisors provide personalized recommendations and insights based on customers' financial goals, market conditions, and risk profiles.3.

Risk Management

: ICBC emphasizes risk management in its wealth management approach, aiming to preserve and grow customers' wealth while mitigating potential risks. Through prudent risk assessment and management strategies, ICBC seeks to safeguard customers' investments and minimize downside risks.4.

Convenience and Accessibility

: ICBC's wealth management services are designed to be convenient and accessible for customers. Whether through online platforms, mobile applications, or physical branches, customers can easily access and manage their investment portfolios according to their preferences and needs.5.

Wealth Planning Solutions

: ICBC offers wealth planning solutions to help customers achieve their longterm financial objectives, such as retirement planning, education savings, and legacy planning. By understanding customers' financial goals and circumstances, ICBC develops tailored wealth management strategies to support their wealth accumulation and preservation goals.

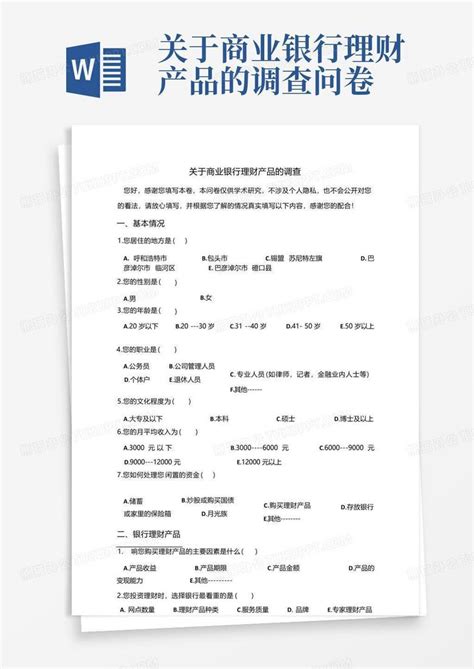

Guidance for Completing the ICBC Wealth Management Questionnaire

When completing the ICBC wealth management questionnaire, consider the following guidance to maximize the effectiveness of the process:

1.

Clarify Your Financial Goals

: Before filling out the questionnaire, take the time to clarify your financial goals, including shortterm and longterm objectives, risk tolerance, and investment preferences. Understanding your financial aspirations will help you provide accurate information and receive personalized recommendations from ICBC.2.

Assess Your Risk Tolerance

: Evaluate your risk tolerance level to determine your comfort level with different investment risks. Consider factors such as investment experience, financial stability, and willingness to accept fluctuations in investment returns. Be honest and realistic about your risk tolerance to ensure that ICBC's recommendations align with your investment preferences.3.

Provide Accurate Financial Information

: When completing the questionnaire, provide accurate and uptodate financial information, including income, assets, liabilities, and investment holdings. Transparently disclosing your financial situation will enable ICBC to assess your investment needs accurately and recommend suitable wealth management solutions.4.

Seek Professional Advice

: If you have any questions or uncertainties while completing the questionnaire, don't hesitate to seek guidance from ICBC's financial advisors. Professional advice can help clarify complex investment concepts, address concerns, and ensure that you make wellinformed decisions regarding your wealth management strategy.5.

Review and Update Regularly

: Periodically review and update your wealth management questionnaire to reflect any changes in your financial circumstances, investment goals, or risk preferences. Regularly reassessing your investment strategy ensures that it remains aligned with your evolving needs and objectives over time.By following these guidelines and leveraging ICBC's wealth management expertise, you can make informed decisions to optimize your investment portfolio and work towards achieving your financial goals effectively.

Conclusion

Industrial and Commercial Bank of China (ICBC) offers a comprehensive suite of wealth management products and services designed to help customers achieve their financial objectives. By understanding ICBC's wealth management offerings and following the guidance for completing the wealth management questionnaire, individuals can make informed decisions to build and manage their investment portfolios effectively. With professional advice and personalized recommendations from ICBC's financial advisors, customers can navigate the complexities of wealth management and work towards realizing their financial aspirations with confidence.