Title: Xuri Enterprise Spends 10 Million HKD to Repurchase 1 Million Shares

Introduction:

Xuri Enterprise recently announced its decision to repurchase a substantial number of shares worth 10 million HKD. This strategic move indicates the company's confidence in its own prospects and a willingness to invest in its own growth. In this article, we will explore the motivations behind share repurchases and their potential impact on Xuri Enterprise and its shareholders.

1. What is share repurchase?

Share repurchase, also known as stock buyback, is the process of a company buying back its own outstanding shares from the market. This can be done through open market transactions or through a tender offer to shareholders.

2. Motivations for share repurchase:

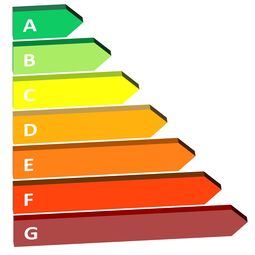

Increase shareholder value: By reducing the number of outstanding shares, earnings per share (EPS) can potentially increase, making the remaining shares more valuable.

Capital allocation: Companies may consider repurchasing shares when they have excess cash on hand and believe that reinvesting in their own business is a better alternative to other investment opportunities.

Defensive strategy: Share repurchase can serve as a defense against hostile takeovers, as it makes the company less attractive to potential acquirers.

3. Implications for Xuri Enterprise:

Boosting confidence: The decision to repurchase shares demonstrates management's confidence in the company's future prospects. This can instill confidence in existing shareholders and potentially attract new investors.

Positive signal: Share repurchase can be seen as a signal that the company believes its shares are undervalued. This could lead to an increase in the stock price, benefiting shareholders.

Dividend substitute: In some cases, companies may choose to repurchase shares instead of paying dividends to distribute excess cash to shareholders. This can be particularly beneficial for shareholders who prefer capital appreciation over regular dividend income.

4. Considerations for shareholders:

Longterm view: Share repurchases alone do not guarantee longterm success. Shareholders should consider the overall financial health and performance of the company, as well as its growth prospects.

Dilution impact: Share repurchases can effectively reduce the number of outstanding shares, potentially increasing the ownership percentage of existing shareholders. This can be advantageous if the company's future earnings growth justifies a higher valuation.

Opportunity cost: Share repurchases utilize cash that could otherwise be allocated to other uses, such as research and development, acquisitions, or debt repayment. Shareholders should assess whether the repurchase is the most effective use of the company's resources.

Conclusion:

Xuri Enterprise's decision to spend 10 million HKD on repurchasing 1 million shares highlights its confidence in the company's future. Share repurchases can be a strategic tool used by companies to increase shareholder value, signal confidence, and defend against takeovers. However, shareholders should consider the broader financial fundamentals and growth prospects of the company, as well as the potential dilution impact and opportunity cost of share repurchases.